Why Experts Predict a Stock Market Rally and Gold Boom

Discover why experts predict a stock market rally and a gold boom. Learn about interest rate cuts, central bank gold purchases, and economic growth trends.

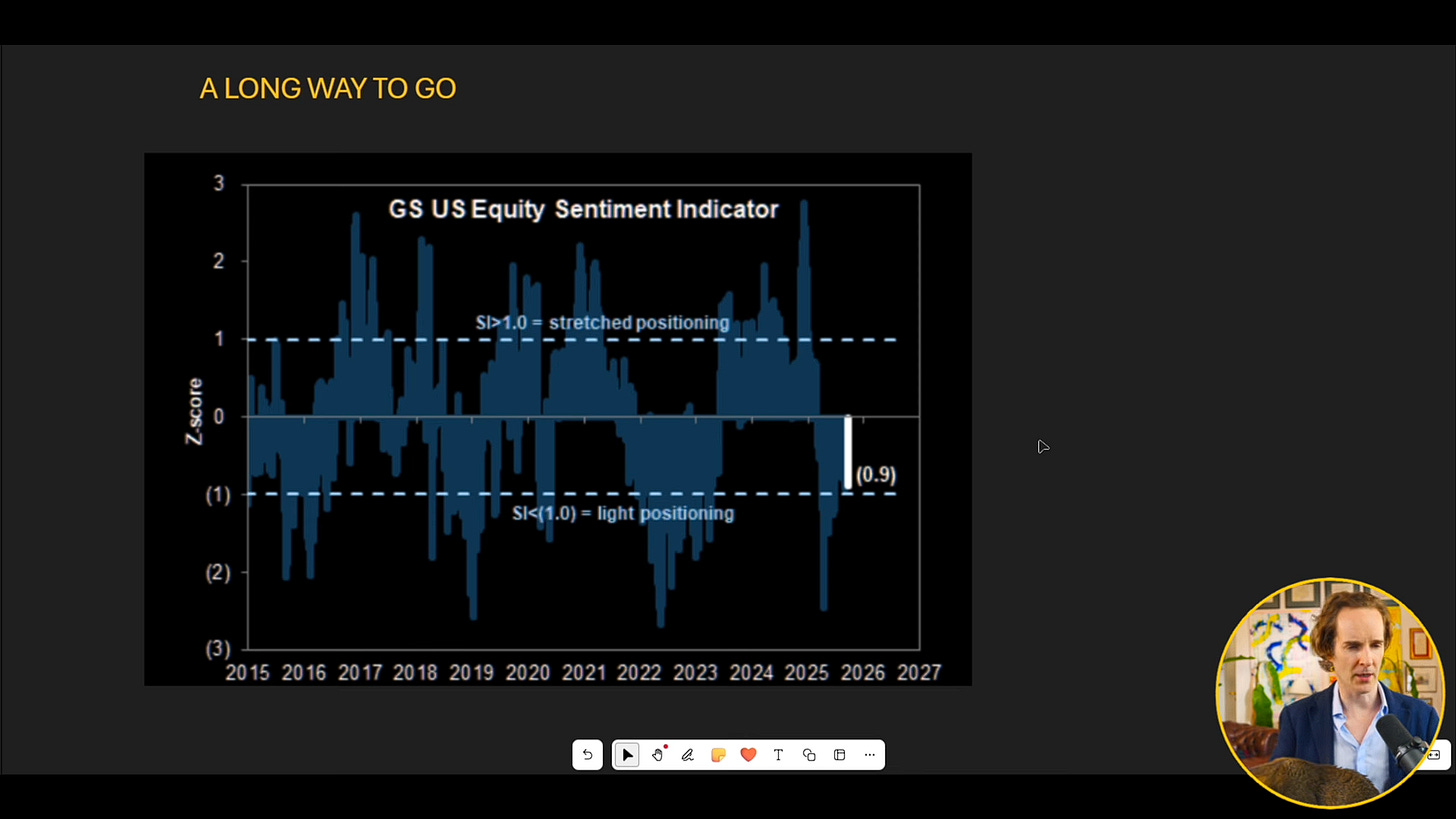

The financial world is buzzing with predictions of a significant stock market rally and a surge in gold investments. Recent insights from Goldman Sachs and other market analysts suggest that a combination of economic factors could create a favorable environment for investors. Here’s a breakdown of what’s happening and why it matters.

Interest Rate Cuts and Economic Growth

Goldman Sachs has forecasted a series of interest rate cuts starting in September, with additional reductions expected in October, December, and March. Lower interest rates typically make borrowing cheaper, which can stimulate economic growth. This environment often benefits stocks, as companies can access capital more easily, and consumer spending tends to rise.

The U.S. economy is also showing signs of resilience, with no immediate signs of a recession. Factors such as fiscal stimulus (government spending) and advancements in artificial intelligence (AI) are expected to drive productivity and economic expansion. These elements create a supportive backdrop for asset growth, particularly in the stock market.

Why Gold is Gaining Attention

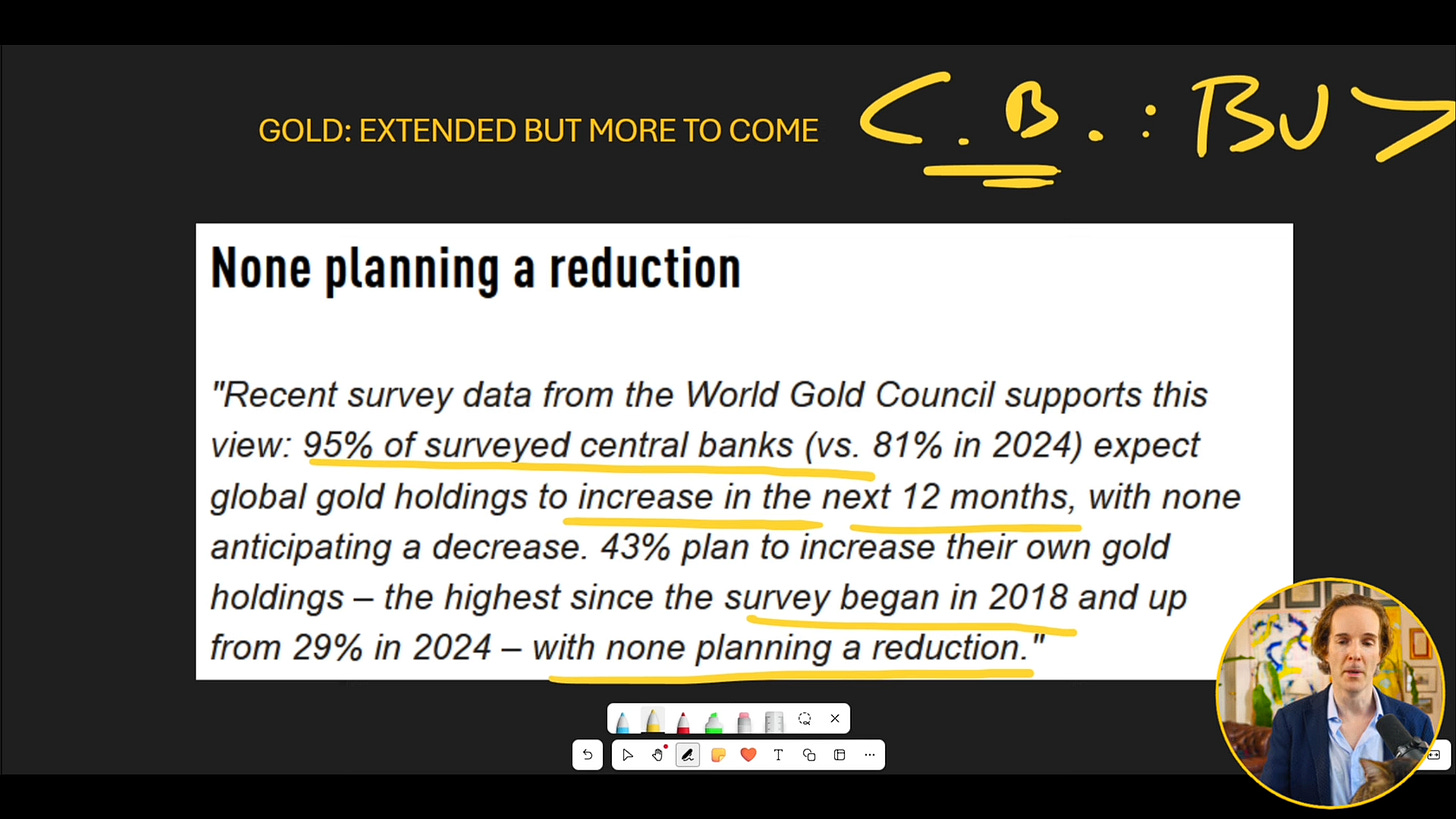

Central banks around the world are increasing their gold reserves. According to recent surveys, 95% of central banks plan to buy more gold in the next 12 months, with none planning to sell. This marks the highest level of gold accumulation since 2018.

China, for instance, is significantly boosting its gold reserves. Historically, much of China’s reserves were held in U.S. bonds, but geopolitical tensions have prompted a shift toward gold. Analysts estimate that China could continue buying 40 tons of gold per month for the next three years, which would bring its reserves closer to the global average for emerging markets.

Gold is often seen as a safe-haven asset during times of economic uncertainty. Its value tends to rise when investors seek stability, making it an attractive option in the current climate.

The Role of AI and Government Spending

Advancements in AI are expected to play a pivotal role in economic growth. Increased investment in AI technologies is driving productivity and innovation across industries. Additionally, government spending on infrastructure, energy, and data centers is at record levels, further fueling economic activity.

What This Means for Investors

The combination of lower interest rates, fiscal stimulus, and technological advancements creates a unique opportunity for investors. While the stock market is expected to rally, not all sectors will perform equally. Analysts predict that specific industries, such as technology and gold mining, may outperform others.

Gold mining stocks, in particular, offer an interesting opportunity. Unlike physical gold, mining companies benefit from the rising value of their reserves, which can lead to higher returns for investors.

Conclusion

The financial landscape is shifting, with interest rate cuts, central bank gold purchases, and technological advancements setting the stage for potential growth. While no investment is without risk, understanding these trends can help investors make informed decisions.

For more insights into financial strategies and market trends, visit the Felix PrehnGoat Academy About Page.