Top 5 Stocks to Buy in June 2025 for Strong Growth

Discover the best five stocks to buy in June 2025, including gold, tech, and crypto picks. Learn why these stocks stand out and how to manage risk for better returns.

Investing in the stock market can be a smart way to grow your money, but choosing the right stocks is important. In June 2025, several companies stand out for their strong performance and future potential. Here are the top five stocks to consider, along with simple explanations of why they are promising picks.

1. Gold Mining Companies

Gold stocks are popular when people want to protect their money from inflation or economic uncertainty. Instead of buying physical gold, many investors choose gold mining companies. These companies own gold in the ground, and when gold prices rise, their profits can grow even faster than the price of gold itself.

When looking at gold stocks, two key things matter:

Cash Generation: This means how much money the company is making from its business.

Return on Investment (ROI): This shows how much profit the company makes compared to the money it invests.

If both cash generation and ROI are rising, it’s a good sign. Also, watching the stock’s price chart helps spot trends. A “bullish setup” means the stock price is moving upward in a steady pattern. Some investors wait for the price to pull back (drop a little) before buying, which can be safer.

2. SSR Mining Inc.

Spreading investments across several gold stocks can lower risk. SSR Mining Inc. is another gold company showing positive trends. Its ROI and cash flow are both improving. The stock price recently broke out of a sideways pattern, which often signals a new upward move. Investors sometimes wait for a “second chance” when the price pulls back before buying.

3. Spotify

Spotify is a well-known music streaming service. It is often compared to Netflix, but for music. The company’s profits and cash flow have been growing every quarter. The stock price has been moving up, with periods of sideways movement called “consolidation.” When the price breaks above this zone, it often leads to a bigger jump. Spotify’s strong business model and steady growth make it a solid choice.

4. Philip Morris International

Philip Morris is a global tobacco company. While tobacco products are not healthy, the company has a strong business with high profit margins. It faces little competition because of strict advertising rules. The stock price is in a bullish trend, and the company continues to make money. Some investors may have ethical concerns, but from a financial point of view, Philip Morris remains a powerful business.

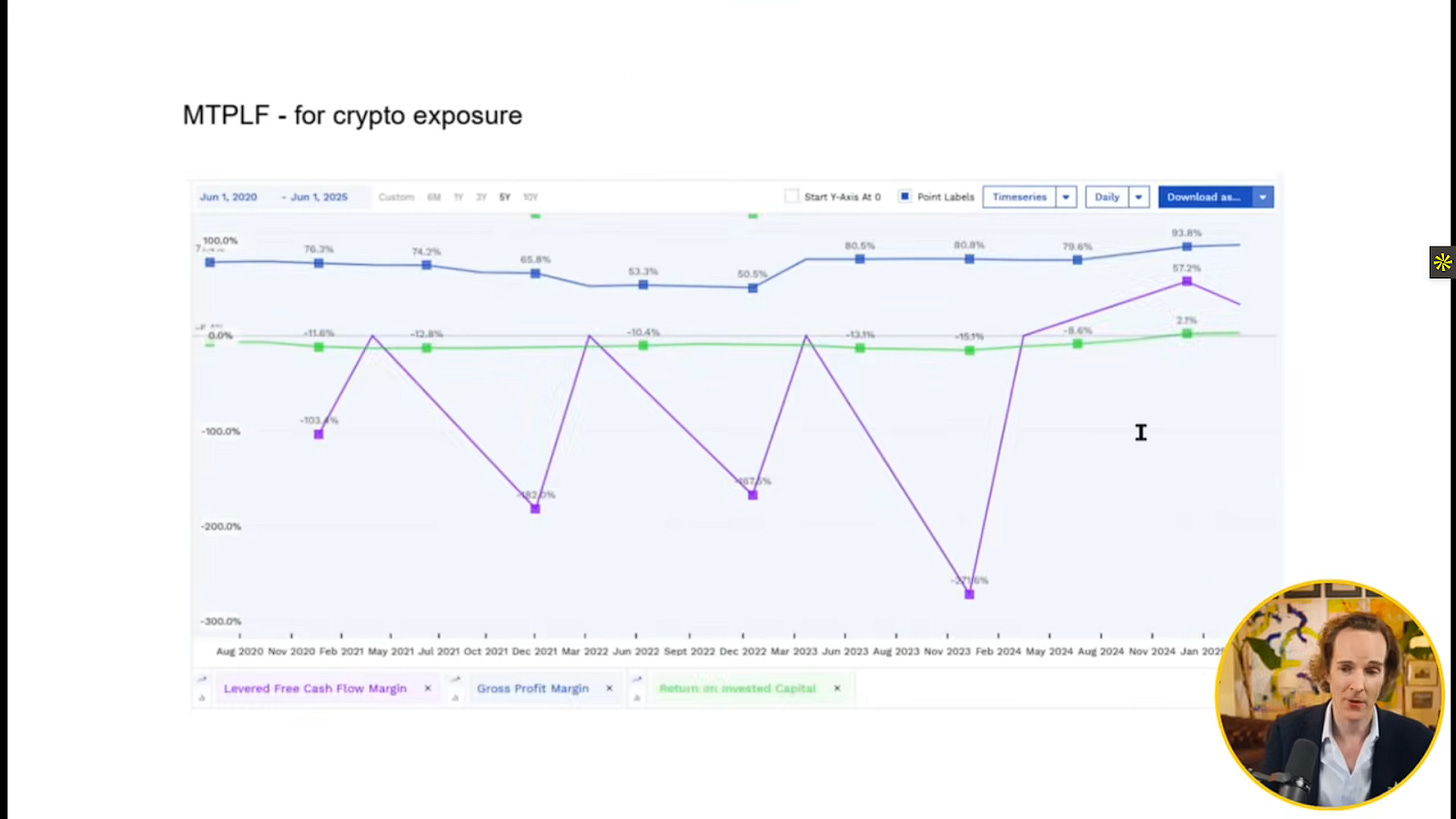

5. Meta Planet

Meta Planet is a unique company from Japan that invests in Bitcoin. In Japan, taxes on crypto profits are high, so Meta Planet offers a way for investors to gain exposure to Bitcoin through the stock market. The company’s business model is similar to MicroStrategy, which is known for holding large amounts of Bitcoin. Meta Planet’s stock price can be very volatile, meaning it goes up and down quickly. This makes it a higher-risk investment, but it also has the potential for big gains if Bitcoin rises.

Key Tips for Investing

It’s important to have a plan for when to buy and sell stocks. Setting a “stop-loss” means deciding in advance to sell if the price drops to a certain level. This helps protect against big losses. Also, don’t buy just because a stock is popular. Look at the company’s financial health and the stock’s price trend.

For more insights on investing and to learn about the team behind these strategies, visit the Felix Prehn and Goat Academy.