Is This the Market Bottom? Felix Prehn’s Goat Academy Insights

Felix Prehn of Goat Academy explains key market signals, government spending, and investor strategies to help you understand if now is the time to buy stocks.

Felix Prehn, the founder of Goat Academy, shares his thoughts on the current state of the stock market. Many investors are asking if now is the right time to buy stocks. Felix explains that the answer is not simple, and it depends on several important factors.

Four Key Factors Affecting the Market

Felix highlights four main reasons that are shaping the market right now:

1. Government Spending:

The U.S. government is planning to spend a large amount of money on defense and technology. This includes billions for new warships, aircraft, and artificial intelligence. Most of this money will go to American companies, which could help the economy and boost some stocks.

2. Manufacturing Recession:

Recent reports show that U.S. manufacturing is in a deep recession. A recession means that the economy is shrinking, and companies are making less. This is worse than the 2008 financial crisis. While lower interest rates might help a little, a recession is usually bad news for the stock market.

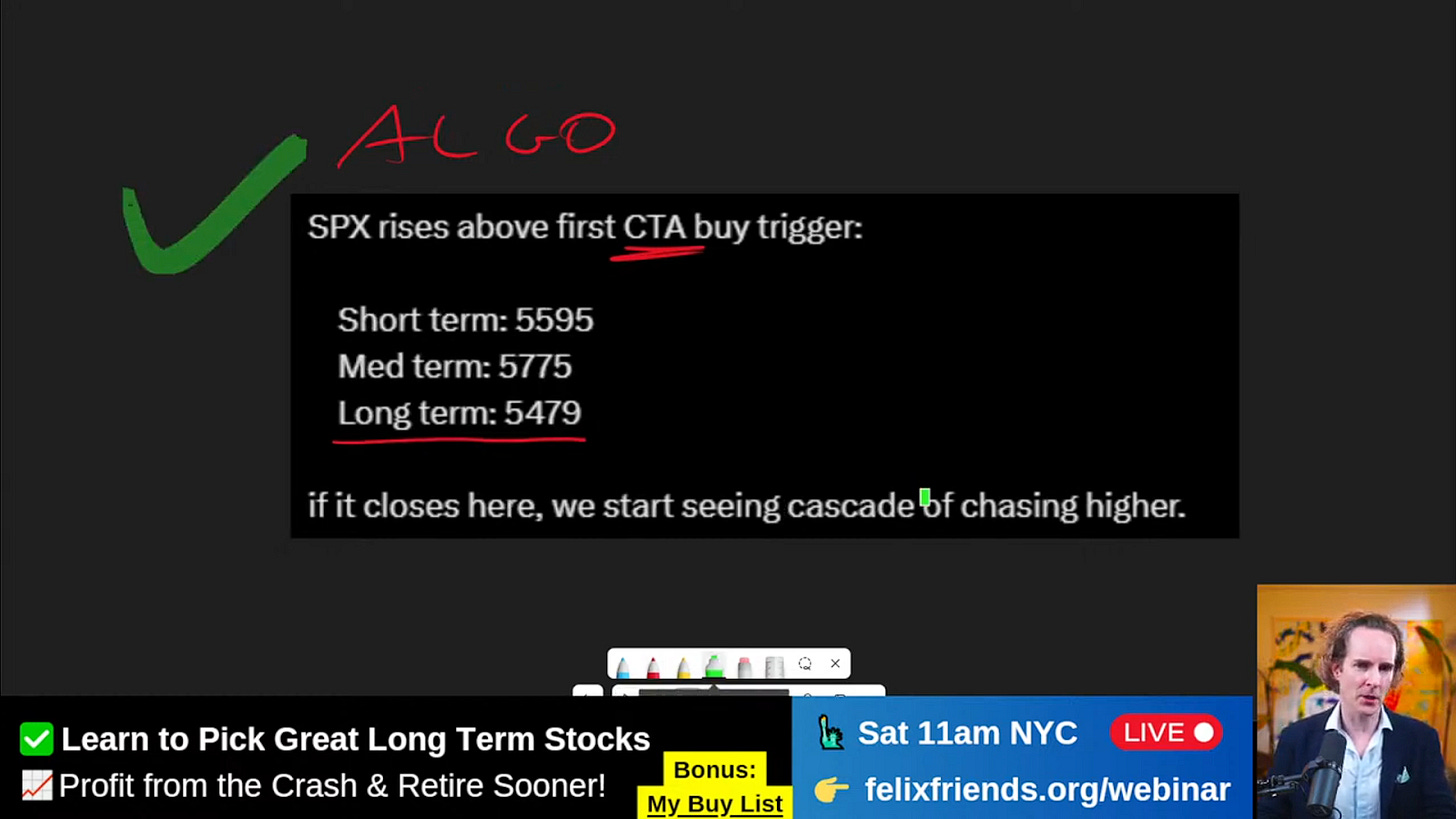

3. Computer Trading (CTAs):

Some investment funds use computer programs, called CTAs (Commodity Trading Advisors), to buy and sell stocks at certain price levels. Recently, these computers started buying when the market reached a specific point. If the market keeps rising, more computer buying could push prices higher. This is a technical factor, meaning it is based on numbers and patterns, not news or company performance.

4. Trade Uncertainty:

There is a lot of confusion about trade deals between the U.S. and other countries, especially China. Some leaders say deals are close, but others deny any progress. This uncertainty makes investors nervous, and markets do not like uncertainty.

What Does This Mean for Investors?

Felix Prehn explains that most investors make mistakes because they do not follow clear rules. Many people buy stocks out of fear of missing out (FOMO) when prices are rising, only to lose money when the market falls again. Successful investors, on the other hand, wait for strong signals before buying. They use risk management tools, like stop-loss orders, which automatically sell a stock if it drops too much. This helps limit losses.

Felix also points out that the market is currently split between good and bad news. Government spending and computer trading are positive, but the manufacturing recession and trade uncertainty are negative. Because of this, the market could go either way.

Learning from Experience

Felix shares stories from the Goat Academy community, where members have learned to set goals, use stop-losses, and make better decisions. He believes that anyone can become a better investor by following proven rules and learning from past mistakes.

For more about Felix Prehn and his approach to investing, visit the Goat Academy About page.