How Global Events Impact Tech Stocks: Insights for Investors

Discover how major world events affect tech stocks like Microsoft, Nvidia, and Tesla. Learn simple strategies to manage risk and spot market opportunities.

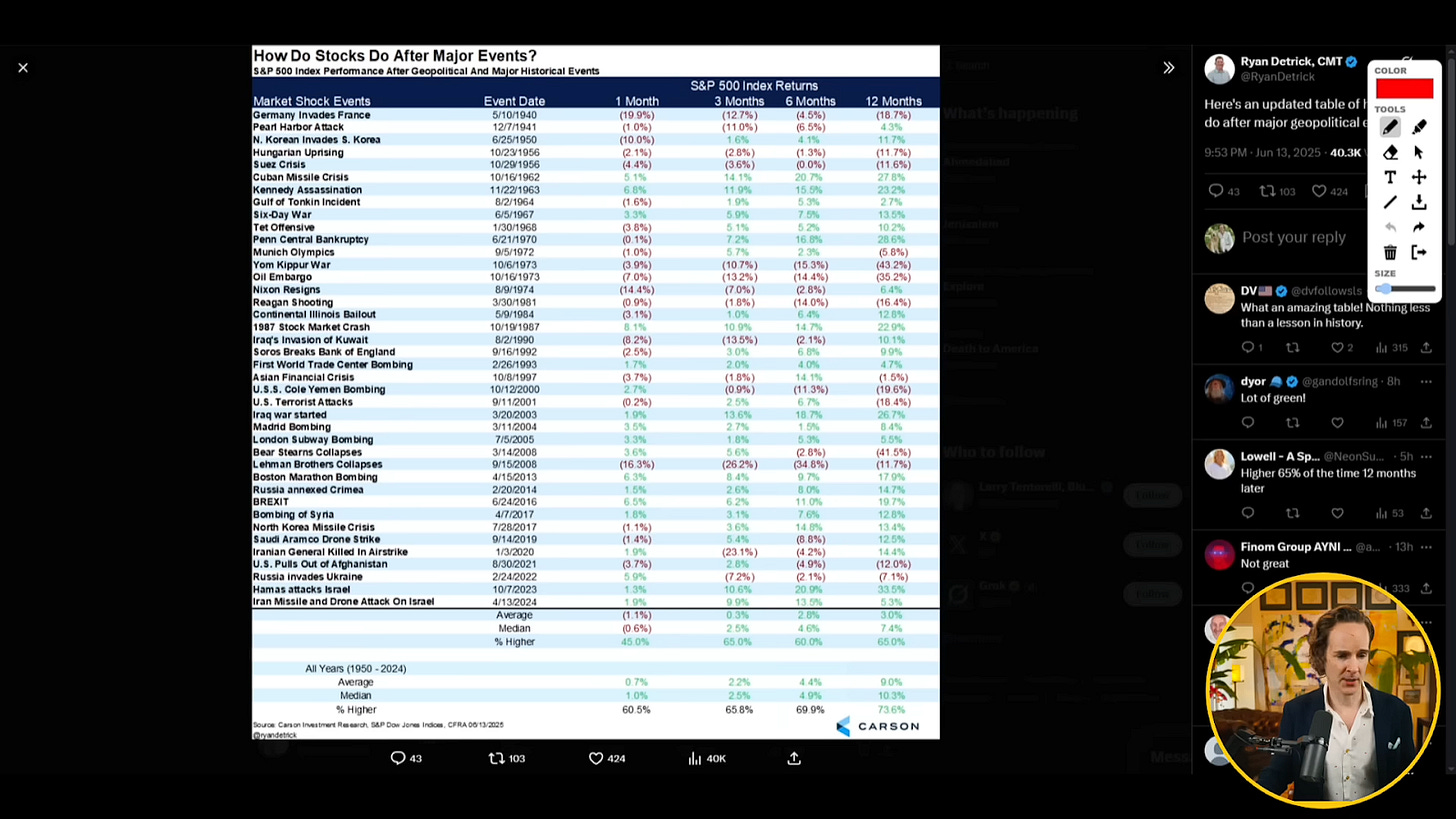

Recent events in the Middle East have left many investors wondering how their favorite tech stocks will perform. With news of conflict and uncertainty, it’s natural to feel concerned about the market. However, history shows that markets often recover after major world events, and understanding this can help investors make better decisions.

Market Reactions to Global Events

When big events happen, such as wars or political changes, stock markets can react quickly. The “VIX,” also known as the “fear index,” measures how much fear or uncertainty there is in the market. A higher VIX means more people are worried about the future. After recent news from the Middle East, the VIX rose but stayed at a moderate level. This suggests that while there is concern, panic has not taken over.

Tech Stocks Remain Resilient

Many large technology companies, including Microsoft, Nvidia, Apple, Amazon, Google, and Meta, have shown strength even during uncertain times. For example, Microsoft and Nvidia only dipped slightly, and their long-term trends remain positive. Amazon even saw gains, and Google recovered quickly after a brief drop.

Apple, however, has faced some challenges. Some investors worry that the company may lack new ideas, which could make it harder to stay ahead in the future. Still, most tech companies continue to sell their products and services, even when global events create headlines.

Understanding Market Trends

Investors often use tools like “moving averages” to spot trends. A moving average is a line on a chart that shows the average price of a stock over a certain number of days, such as 50 or 150 days. If a stock price stays above its moving average, it is usually a good sign. For example, Tesla recently recovered and moved higher, but it still faces resistance at its 150-day moving average.

Another tool is the “dark pool,” where large investors make big trades that are not immediately visible to everyone. Watching these trades can give clues about what big investors think will happen next.

Sector Highlights: Fintech, Gold, and Energy

Fintech companies like PayPal and SoFi had a tough day, with PayPal dropping sharply. This was partly due to rumors that big retailers like Amazon and Walmart might use “stablecoins” (a type of digital money) to handle payments, which could reduce the need for traditional payment companies.

Gold stocks have performed well, often rising more than the price of gold itself. This is because gold mining companies can earn more when gold prices go up. Energy stocks, especially those related to oil, have also seen gains as global events affect supply and demand.

What Should Investors Do?

History shows that after major world events, markets often recover within a few months. The key is to focus on strong companies and manage risk carefully. Diversifying investments and using tools like moving averages can help investors make better choices. It’s also important to avoid making decisions based on fear.

For those interested in learning more about investing strategies and market analysis, read about Felix Prehn and Goat Academy.