Felix Prehn’s Top 2025 Stock Picks from Goat Academy

Discover Felix Prehn’s top stock picks for 2025, why tech stocks are lagging, and which sectors are outperforming. Learn more about Goat Academy’s investment insights.

Felix Prehn, the founder of Goat Academy, has shared his latest insights into the stock market for 2025. While many investors are focused on tech stocks, Felix highlights why other sectors are currently outperforming and shares his top stock picks for the year.

Why Tech Stocks Are Underperforming

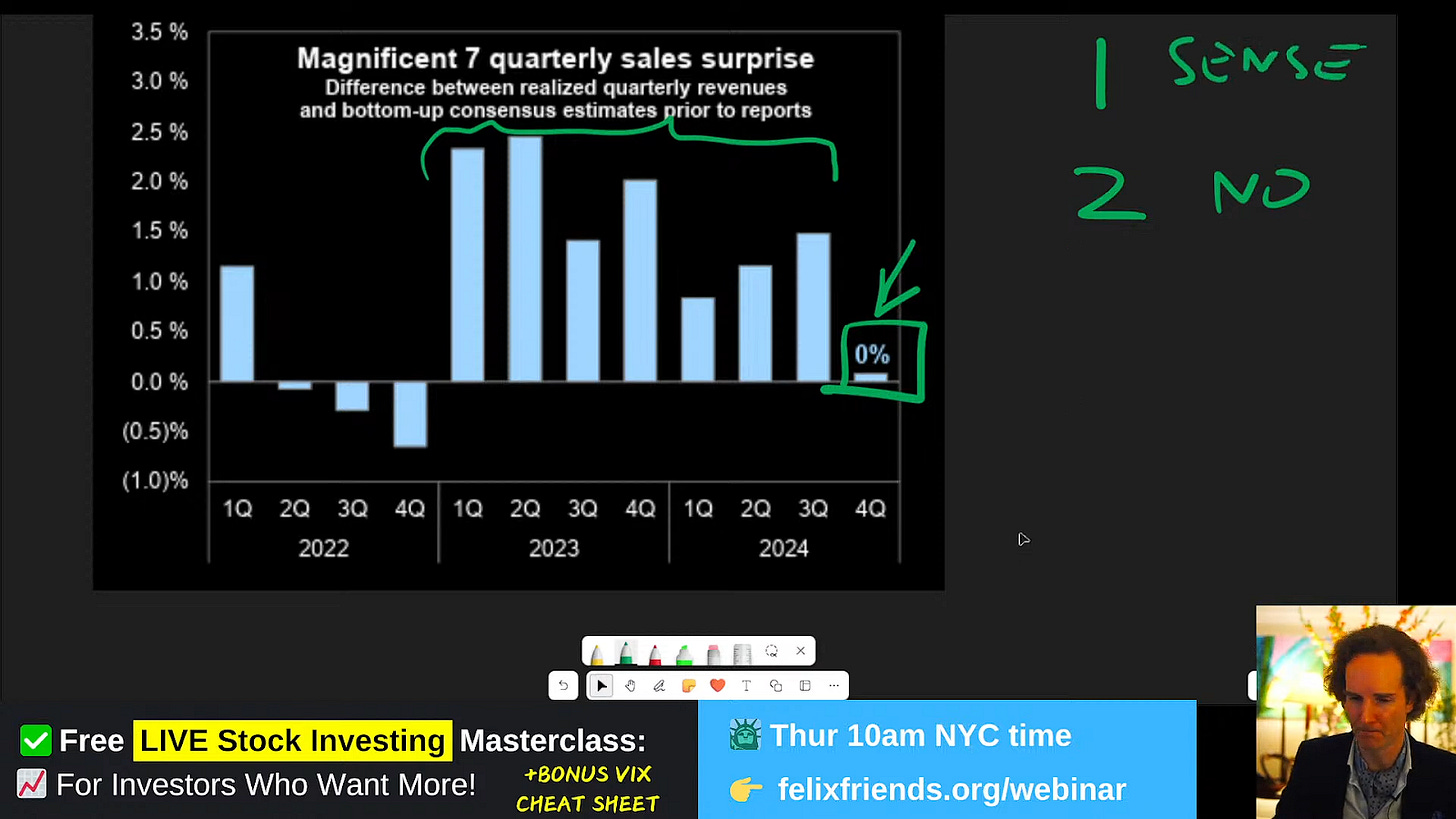

For years, technology stocks have been the darlings of the market. Companies like Nvidia and other members of the "Magnificent Seven" have delivered exceptional returns. However, in 2025, these stocks are no longer outperforming as they once did.

The reason? Growth in earnings for these tech giants has slowed. While they are still profitable, their performance is now meeting expectations rather than exceeding them. Meanwhile, other sectors are catching up, creating a more balanced market.

Sectors Outperforming in 2025

Felix points out that seven key sectors are currently beating the S&P 500 index. These include:

Communications

Materials

Energy

Utilities

Industrials

Financials

Healthcare

Among these, communications and financials are leading the way. This shift shows that investors are diversifying beyond tech and looking for opportunities in other industries.

Felix Prehn’s Top Stock Picks

Felix has identified four stocks that he believes are strong buys in 2025. While he doesn’t reveal all the names in this discussion, he emphasizes the importance of focusing on sectors with strong earnings growth.

One example he mentions is FOA (Finance of America), which has seen significant gains, up by 180% in recent months. This reflects the broader trend of financial stocks outperforming as the market shifts away from tech.

What This Means for Investors

Felix encourages investors to think beyond the traditional tech-heavy portfolios. With the "Magnificent Seven" no longer delivering outsized returns, it’s time to explore other sectors. The narrowing gap between tech and the rest of the market suggests that diversification is key to success in 2025.

Additionally, Felix advises against being swayed by fear-driven headlines about overvalued markets. Instead, he focuses on data, such as the high percentage of companies showing positive earnings growth, which supports a bullish outlook for the year.

Final Thoughts

Felix Prehn’s insights from Goat Academy highlight the importance of adapting to changing market conditions. By focusing on sectors with strong performance and diversifying beyond tech, investors can position themselves for success in 2025.

For more about Felix Prehn and Goat Academy, visit the About Page.